Litecoin (LTC) is a decentralized cryptocurrency created in 2011. It operates on a principle similar to Bitcoin but is designed for faster transaction confirmations. Its network processes blocks approximately every 2.5 minutes, making it a functional option for digital payments. As a global asset, the methods for acquiring Litecoin can vary significantly depending on your location.

Understanding how to navigate these differences is key for anyone looking to add Litecoin to their portfolio. This article explains the regional variations in buying options and provides a general framework for international users to purchase this digital asset securely and efficiently.

Regional Variations in Buying Litecoin

The process of buying Litecoin is not uniform across the globe. The available platforms and payment methods are heavily influenced by local factors. Financial regulations, the maturity of the digital asset market, and the infrastructure of local banking systems all play a part in determining how you can acquire LTC in your country.

For instance, some countries may have a wide array of cryptocurrency platforms with numerous funding options, while others might have more restrictive environments. This geographic diversity means that a payment method popular in one region may not be available in another.

Common Payment Methods and Their Availability

Users have several ways to fund their accounts for purchasing Litecoin. The availability of these methods often depends on the user’s country of residence and the policies of the chosen cryptocurrency platform.

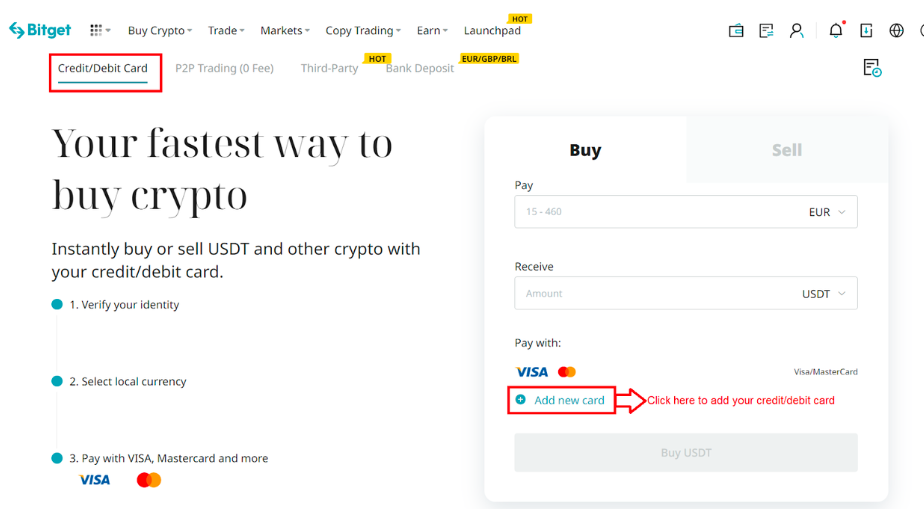

- Credit and Debit Cards: Using a credit or debit card is one of the most common and quickest ways to buy digital assets. It allows for instant purchases. However, this option may not be available in all countries due to local banking regulations.

- Bank Transfers: Bank transfers are another widely supported method. In Europe, SEPA (Single Euro Payments Area) transfers offer an efficient way to fund an account with Euros. For other international transactions, SWIFT transfers are a common alternative, though they may take longer to process.

- Digital Payment Services: Modern payment services, including options like Google Pay or Apple Pay, offer a convenient way to buy cryptocurrencies. Their availability is tied to both the user’s region and the specific platform being used.

- Third-Party Payment Channels: Some platforms integrate with various third-party payment processors. Users should check which of these channels are supported in their specific area to find additional purchasing options.

General Steps for International Litecoin Purchases

Despite regional differences, the fundamental process for buying Litecoin is consistent across most international platforms. By following a clear set of steps, users can navigate the process regardless of their location. This standardized approach ensures a secure and straightforward experience.

A Step-by-Step Guide

- Create an Account: The first step is to register on a reliable cryptocurrency platform. This typically involves providing an email address and confirming your country of residence. This information helps the platform present you with the correct payment options available in your region.

- Complete Identity Verification: Most reputable exchanges require users to complete an identity verification process, often known as Know Your Customer (KYC). This is a regulatory requirement to prevent fraud and involves submitting a valid government-issued ID. Verification times can vary.

- Connect a Funding Method: After your account is verified, you need to link a payment source. This could be your bank account for transfers, your debit or credit card, or another supported payment service. Choose the method that best suits your needs and is available in your country.

- Complete Your Purchase: With a funded account, you can proceed to buy Litecoin. You will typically need to specify the amount of local currency you wish to spend or the amount of LTC you want to purchase. For those seeking more detailed guidance on this final step, you can follow a guide on how to buy litecoin for additional instructions.

Post-Purchase Considerations

After acquiring Litecoin, it is important to consider how you will store and manage it. You also need to be aware of transaction fees and potential tax obligations.

Storing Your Litecoin

Once you buy Litecoin, you have a few storage options. You can leave it on the exchange where you bought it, which is known as a “hot wallet.” This is convenient for active trading. Alternatively, you can transfer your LTC to a personal cryptocurrency wallet. These “cold wallets” or hardware wallets are offline devices that offer a higher level of security because they are not connected to the internet.

Fees and Taxes

Be aware that buying cryptocurrency involves fees. These can vary based on the platform, payment method, and the size of your transaction. It is wise to review the fee structure before completing a purchase. Furthermore, profits from buying and selling crypto assets may be subject to taxes in your jurisdiction. Consulting with a local tax professional is recommended to ensure compliance.